When the sheet of carbon was first isolated in 2004 at Manchester University, the breakthrough rocked the scientific world. Countless applications for the “miracle substance” were envisioned, from storing solar power to stitching batteries into bodies. At the EU, plans to capitalize on the material’s promise were drawn up.

In 2013, the bloc launched the Graphene Flagship, an initiative to commercialize the material. Backed by a €1 billion budget and nearly 170 academic and industrial partners spanning 22 countries, the project raised hopes of Europe becoming a graphene powerhouse. The early “graphene gold rush,” however, didn’t immediately lead to riches. But a promising sector is slowly emerging on the continent.

Among Europe’s torchbearers is Inbrain Neuroelectrics. Founded in 2019, the Graphene Flagship spinoff uses the material to develop neural interfaces. Next year, the Spanish startup plans to lay another graphene milestone in the UK: the first time the material has been implanted in a human brain.

Inbrain’s landmark trial will assess the suitability of graphene-based implants for treating brain conditions. If proven safe and effective, the material could bring numerous advantages to neural interfaces.

We can also see the biomarkers at least 10 times better.

Carolina Aguilar, Inbrain’s cofounder and CEO, highlights three particular benefits: miniaturization, reliability, and high-resolution brain signals. This combination enables Inbrain to decode detailed biomarkers from neural activity, while minimizing power consumption and ensuring stability. In time, the devices could produce personalized, therapeutic treatments for neurological disorders.

These features differentiate graphene from more commonly-used metals, such as platinum-iridium. Miniaturizing these materials can impair their durability and electrical impedance.

“We can also see the biomarkers at least 10 times better than with platinum-iridium,” says Aguilar. “And in some cases, platinum doesn’t even detect these biomarkers, these brainwaves that are key to not only detect, but also to stimulate and then correct.”

Graphene also gives Inbrain an edge over Neuralink, Elon Musk’s brain chip startup. Neuralink devices use a material called Pedot, which degrades far more quickly than graphene.

These qualities, however, are no guarantee of commercial success. Despite its unique properties, bringing graphene to market remains a challenge.

Leaving the lab

The Graphene Flagship is not without its critics. Pundits have questioned the value of the EU’s immense investment, and the slow process of developing real-world applications. The speed, however, should not be too surprising.

“Science is the easy part,” said Konstantin Novoselov, one of the Manchester University scientists who won a Nobel Prize for isolating graphene. “To develop a technology, you should know what products you are aiming at, and this should be coming from the industry.”

Taking a novel material from discovery to commercialization frequently takes decades. In graphene’s development, arguably the biggest current problem is providing cost-effective production.

One of the most auspicious solutions was pioneered by Paragraf, a company that commercializes graphene-based electronics. The Cambridge University spin-out has developed a method of producing high-quality graphene on semiconductor wafers of up to 20 cm in diameter.

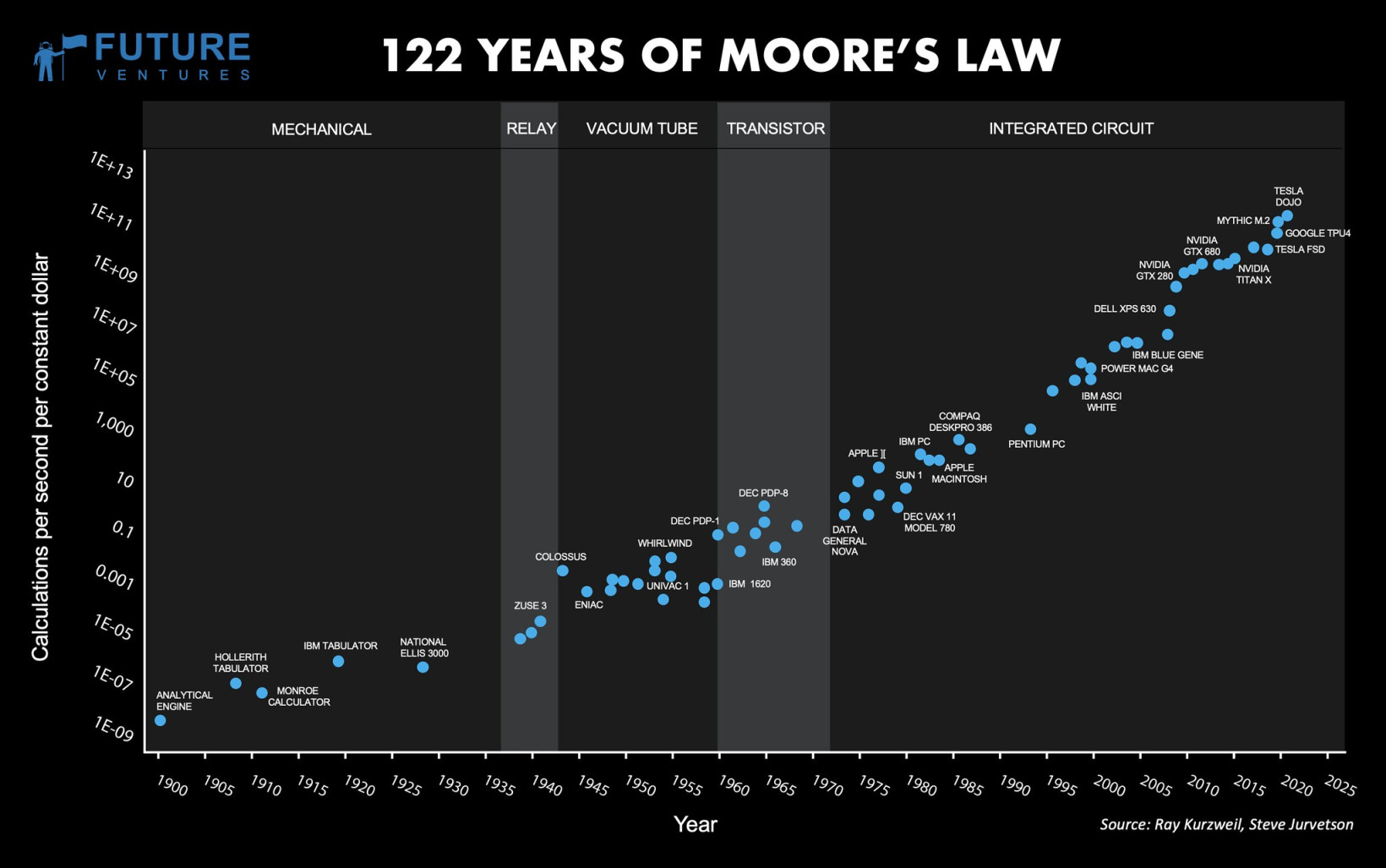

Graphene can reboot Moore’s Law.

Paragraf claims to be the first company to offer scalable manufacturing of graphene-based electronic devices.

“The challenge has been to mass produce graphene in electronics with standard semiconductor processes,” Paragraf CCO Tom Wilson tells TNW. “Paragraf has actually done that. Paragraf has made graphene an industry-ready solution.”

Paragraf’s graphene-based sensors can power an array of applications, from quantum computers to rapid COVID- 19 tests. Early customers include Rolls-Royce and the Cern research lab.

Wilson is bullish about graphene’s benefits to computer chips.

“Many are familiar with Moore’s Law, where the advantages we get of going smaller, submicron, have been flattening out over time. Graphene has the promise of rebooting Moore’s Law.”

This potential, however, is being inhibited by a global semiconductor shortage.

A global race is heating up

The Paragraf team has voiced frustration with the UK’s delay in launching a semiconductor strategy. They have also raised concerns about the post-Brexit talent pipeline and the inadequate support for university spin-offs.

In August, Paragraf CEO Simon Thomas threatened to move the company’s base to the US because the British government “doesn’t know what it’s doing.”

Wilson adds that clear trade and customs agreements are required to ease the acquisition of capital goods, alongside new immigration policies to improve access to talent.

Whichever way they go, the key is clarity.

“While we would certainly welcome it if the UK government could find the money to create the equivalent of a US or European ‘chips act,’ we do not expect this to happen,” he says.

“What we do hope is that the government will provide the necessary support either by getting out of the way or by putting in place supportive legislation — whichever way they go, the key is clarity and the removal of uncertainty so business can get on and do what it does best.”

The EU, meanwhile, could greenlight its European Chips Act by the end of the year. The new legislation aims to ramp up the bloc’s share of global chip production from the current 5% to 20% by the end of 2030.

That would be a boost to Inbrain’s tech, which also relies on semiconductors. For Aguilar, the company’s CEO, the EU’s biggest shortcomings are insufficient venture capital and infrastructure support.

“For R&D, Europe has spent a lot on the R and not much on the D,” she says.

Despite the challenges, optimism about graphene’s future is growing once again. Wilson believes that “a revolution in advanced materials electronics” has begun. But Europe still needs to cement its place in the vanguard.

Production challenges, funding gaps, and competition from China and the US remain major obstacles to the EU’s ambitions. The bloc still has to find mass markets for the wonder material.